Financial Instruments Toolbox

Financial Instruments Toolbox provides functionality for pricing, modeling, hedging, and managing an instrument portfolio. You can analyze cash flows for fixed-income securities and derivative instruments including interest-rate, inflation, equity, commodity, credit, and energy instruments. The toolbox provides a modular framework that supports a wide range of workflows and enables you to price instruments with a variety of models and pricing methods.

Curve Models

Analyze or bootstrap interest-rate curves from market data using ratecurve. Estimate parameters for yield curve models using a parametercurve object.

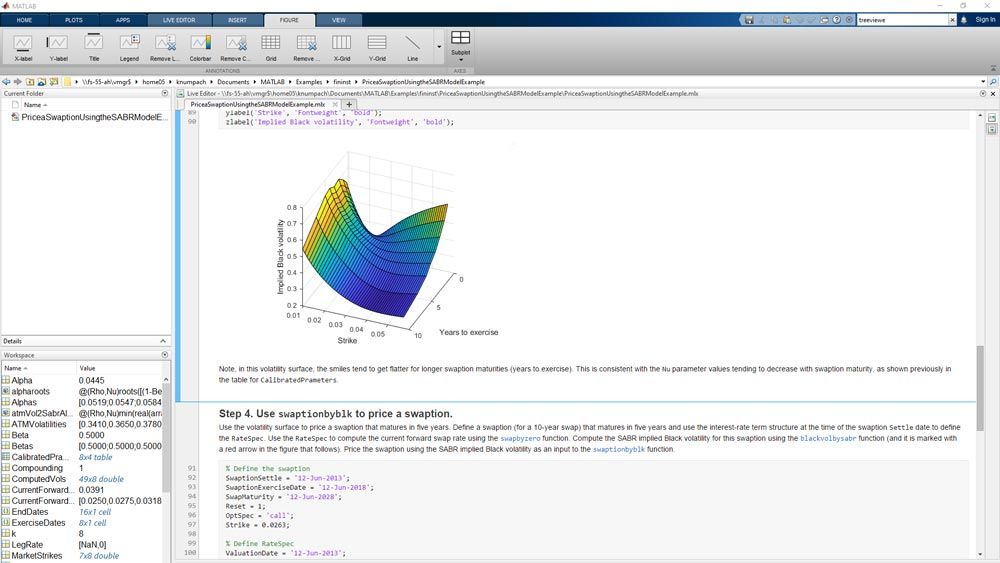

Interest-Rate Instruments

Price, compute sensitivity, and perform hedging analysis for interest-rate securities. Price bonds, floating-rate notes, swaps, swaptions, caps, and floors with pricing models that include lattice models, Monte Carlo simulations, and closed-form solutions.

Inflation Instruments

Build an inflation curve, calculate index values, and price inflation bonds, Year-on-Year Inflation-Indexed Swaps, and Zero-Coupon Inflation Swaps.

Equity, FX, Commodity, or Energy Instruments

Price Vanilla and exotic options with Black-Scholes and stochastic volatility models using Monte Carlo simulations, multiple closed-form solutions, and finite differences methods.

Credit Derivative Instruments

Price credit default swaps and credit default swap options. Compute the default probability and hazard rate values from market data. Price credit instruments using a default probability curve.

Instrument Portfolios

Define portfolios of heterogenous assets and then calculate the price and sensitivities of all instruments in the portfolio.